Martin Lewis is here yet again with more savvy advice to save cash on a monthly basis.

The finance guru, who spends his days saving us cash via his Money Saving Expert team, has said it's more important than ever to make sure we're checking the fine print when it comes to getting paid.

The Manchester native, who himself is worth £120 million, doesn't let his wealth take over his working class roots.

Advert

If there's a free pint to be claimed, he's here to let us know how to secure the deal.

When it comes to getting paid, though, Lewis has stressed that 'millions' are currently receiving payslips that are wrong.

And when we say wrong, we don't mean the amount being paid.

Nope, it's one of the more technical aspects that might sound a bit boring but it's essential to your wage being right.

Advert

Lewis is on about your tax code, which he said could 'cause a nightmare' given how many are paying the incorrect rates.

The warning came on the Martin Lewis BBC Radio 5 Live Podcast back in February. But with wages for millions going up as of 1 April, the timing couldn't be better to make sure you're getting the money you're owed.

Speaking on the podcast, Lewis said: "You need to know your tax code and what it means, it's your legal responsibility - not your employers and not HMRC’s.

Advert

"Millions are wrong. Millions are overpaying. Millions are underpaying.

"It all causes a nightmare, so make sure you know what your tax code is and check that it's right."

Lewis' comments came after one listener, Sue, contacted the podcast team. She used to teach adult accountancy classes and told Lewis and his team that 'the number who didn't have a clue if they were paying the right tax at work was worrying'.

"These students were mature adults who had been working and were now within an accounting environment therefore earning for years, they weren’t fresh out of college," Sue said.

What is a tax code and is mine right?

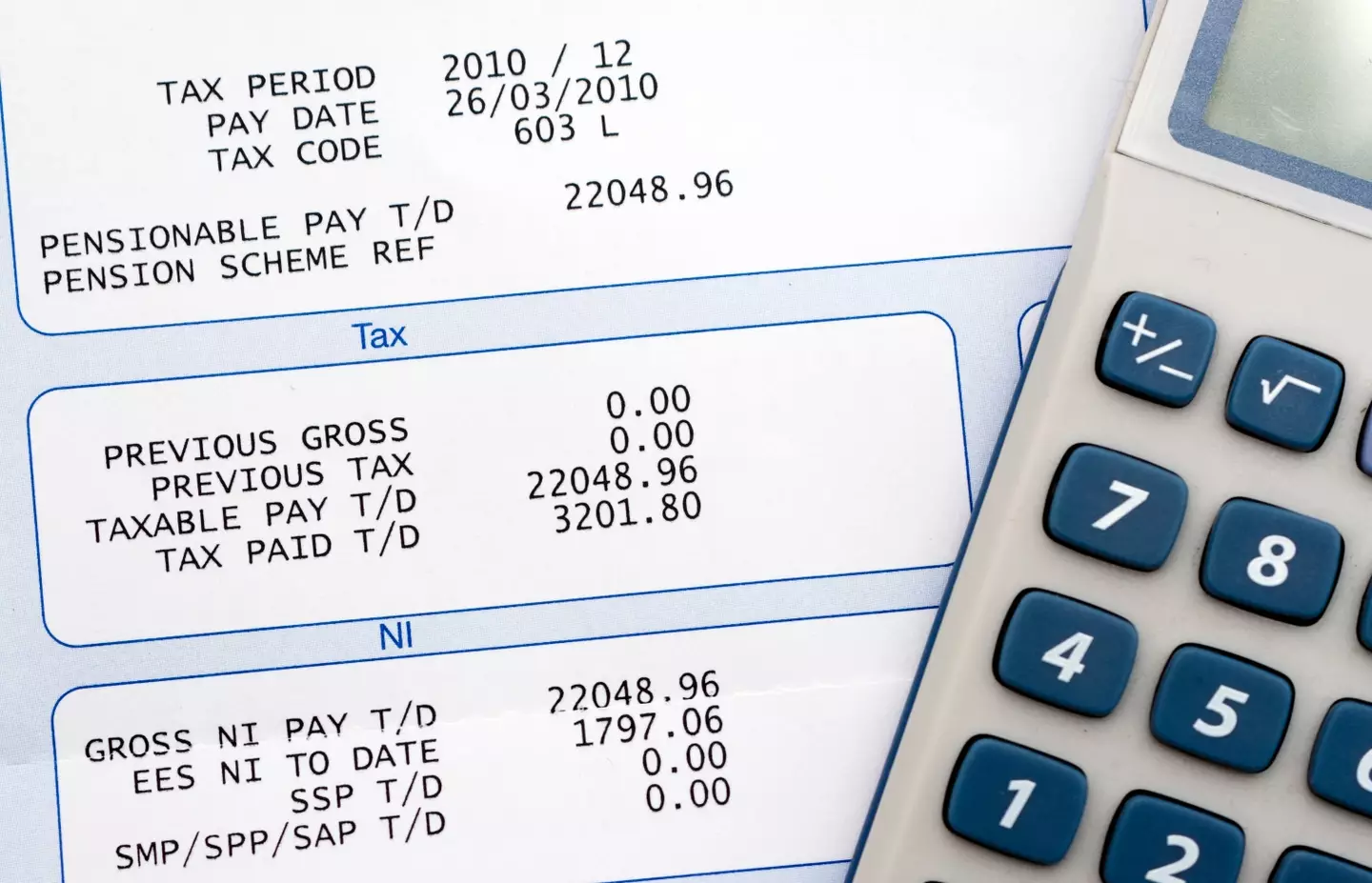

The most common tax code in the country is 1257L. This is used for most people who has one job or pension.

Advert

If you have this, you're probably paying the right amount and there's nothing to do.

But if 1257L is followed by W1, M1, or X, you may well paying emergency rates of tax which means you're paying too much and need a refund from HMRC.

Tax codes with ‘K’ at the beginning mean you have income that is not being taxed another way and it’s worth more than your tax-free allowance.

For most people, this happens when you’re paying tax you owe from a previous year through your wages or pension, or getting benefits you need to pay tax on (such as state benefits or company benefits).

Advert

Your employer or pension provider takes the tax due on the income that has not been taxed from your wages or pension - even if another organisation is paying the untaxed income to you.

You can check your tax code on Gov.uk.

Featured Image Credit: ITV / Getty Stock ImagesTopics: Cost of Living, Education, Martin Lewis, Money, UK News, BBC