For those in debt, paying off hefty loans may feel like an impossible task... but it is a task that is usually best to tackle head one instead of allowing it to get even worse.

There are plenty of methods out there for bettering your finances, and TikTok user Devamsha (@yoitsdevvie) claims she's discovered one that allowed to clear £4,000 of consumer debt in just two years. Take a look below:

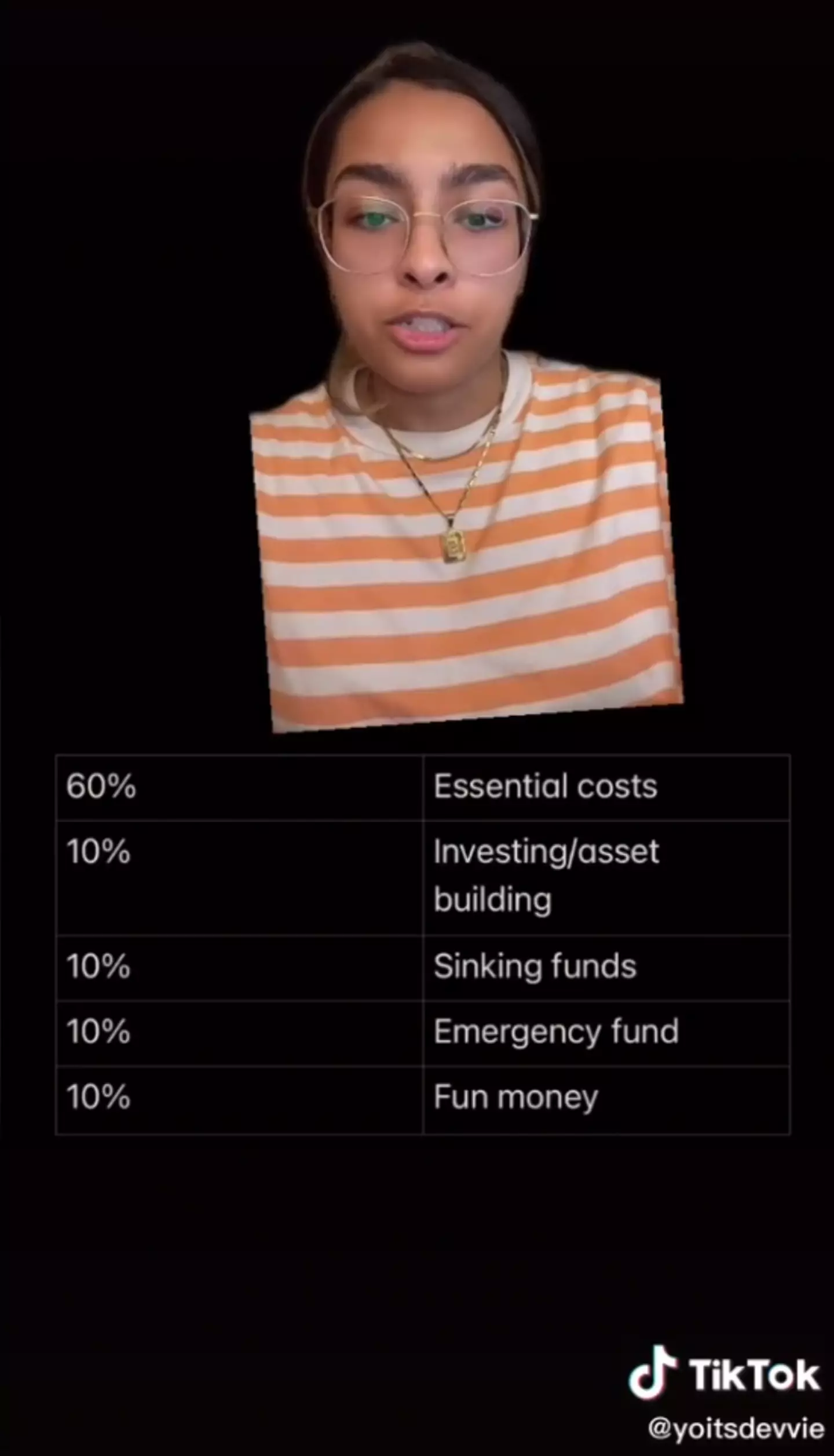

Described as 'salary bucketing', Devamsha explains how she divides her paychecks up into five different parts.

Advert

60 percent goes towards essential living costs, 10 percent towards paying off her debts, 10 percent for investments and asset building, 10 percent for fun money and the last 10 percent goes into an emergency fund.

Devamsha says that 'this method works really well if you have different accounts for each of the percentage bucket', especially if you set up a standing order for this to happen automatically - meaning that you won't even have to do it yourself and won't be tempted to change the percentages so you can make unnecessary purchases.

Devamsha continued to give advice to those commenting on the video, with one asking what to do if your essential costs are more or less than 60 percent of your salary.

She posted a video response to this, explaining how you can try to bring your essential costs down, such as getting a roommate or using the heating less.

But if necessary, you can change up the percentages and cut some, such as investing or fun money out completely.

Other methods for clearing debts include the debt snowball method, used by former gambler Brian Mitchell.

The snowball method involves listing your debts from the lowest balance to the highest (regardless of interest rate), and start throwing everything you can at the lowest debt - all while continuing to pay the minimum payments on the rest.

Another option is the avalanche method where you pay your most immediate debts first, normally the ones with the highest interest rates, before moving onto the smaller or less demanding payments.

If you're in serious debt, you can also seek professional advice from a number of organisations:

Citizens Advice (0800 144 8848)

StepChange (0800 138 1111)

National Debtline (0808 808 4000)