Workers in the UK will see more money in their back accounts from next month, following changes announced in last week's Spring Budget.

It's always a little depressing when you see your payslip and notice just how much is taken out of your salary every month.

With tax, national insurance, student loans and pension payments, a huge chunk of your wage disappears before it even hits your bank account.

Advert

But thanks to a new change, many Brits will be slightly better off.

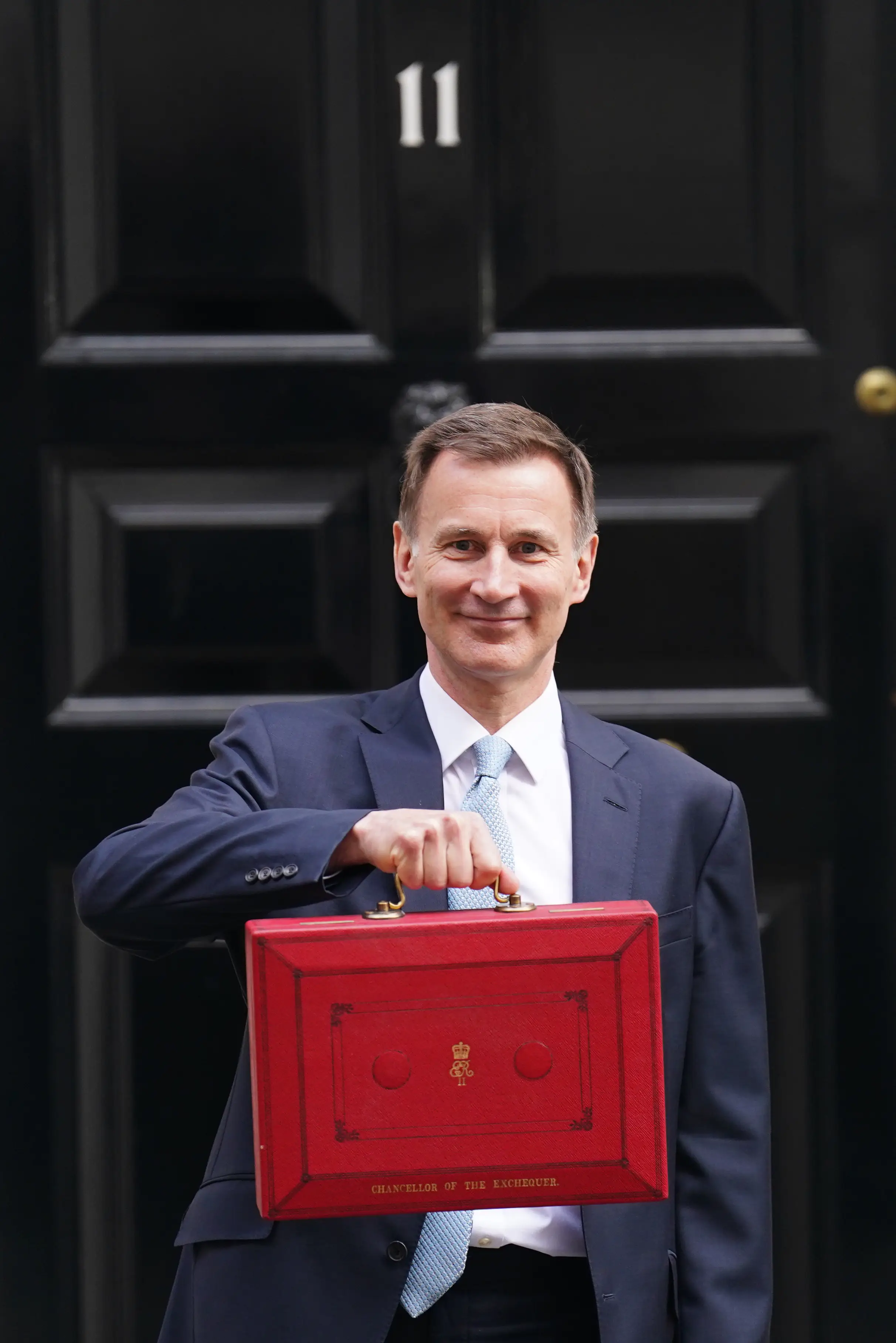

On 6 March, chancellor Jeremy Hunt set out a range of new financial measures in the House of Commons.

In what was an expected announcement, Hunt explained that National Insurance (NI) was to be slashed by two pence.

This will put money back into the pockets of some 27 million people in the United Kingdom.

National insurance contributions will be cut from 10 per cent to eight per cent on earnings between £12,570 and £50,270 a year.

While NI isn't paid on earnings below £12,750, there'll be no change to contributions on earnings over the upper limit of £50,270, either.

However, some will not benefit from the news.

Martin Lewis explained that if you earn between £12,750 and £26,000, or over £60,000, there will be nothing to gain.

Over on Money Saving Expert, they explain that both national insurance and income tax thresholds have been frozen since 2021 and are set to stay frozen until 2028.

"What freezing the threshold does is that it means no matter what you earn, as your earnings increase, a bigger proportion of your earnings goes on tax. And that's how the Chancellor makes money from it," explains Martin.

Although workers earning between £26,000 and £60,000 will gain more from the national insurance cut than they would lose from the freeze, those earning between £12,750 a year and £26,000 - or for those earning more than £60,000 - will see no benefit.

This is because the change is offset by the national insurance threshold freeze.

Speaking of the changes, Hunt said: "Keeping taxes down matters to Conservatives it never can for Labour. We believe that in a free society the money you earn doesn't belong to the Government, it belongs to you.

"And if we want to encourage hard work, we should let people keep as much of their money as possible. Lower taxed economies have more energy, more dynamism, and more innovation."