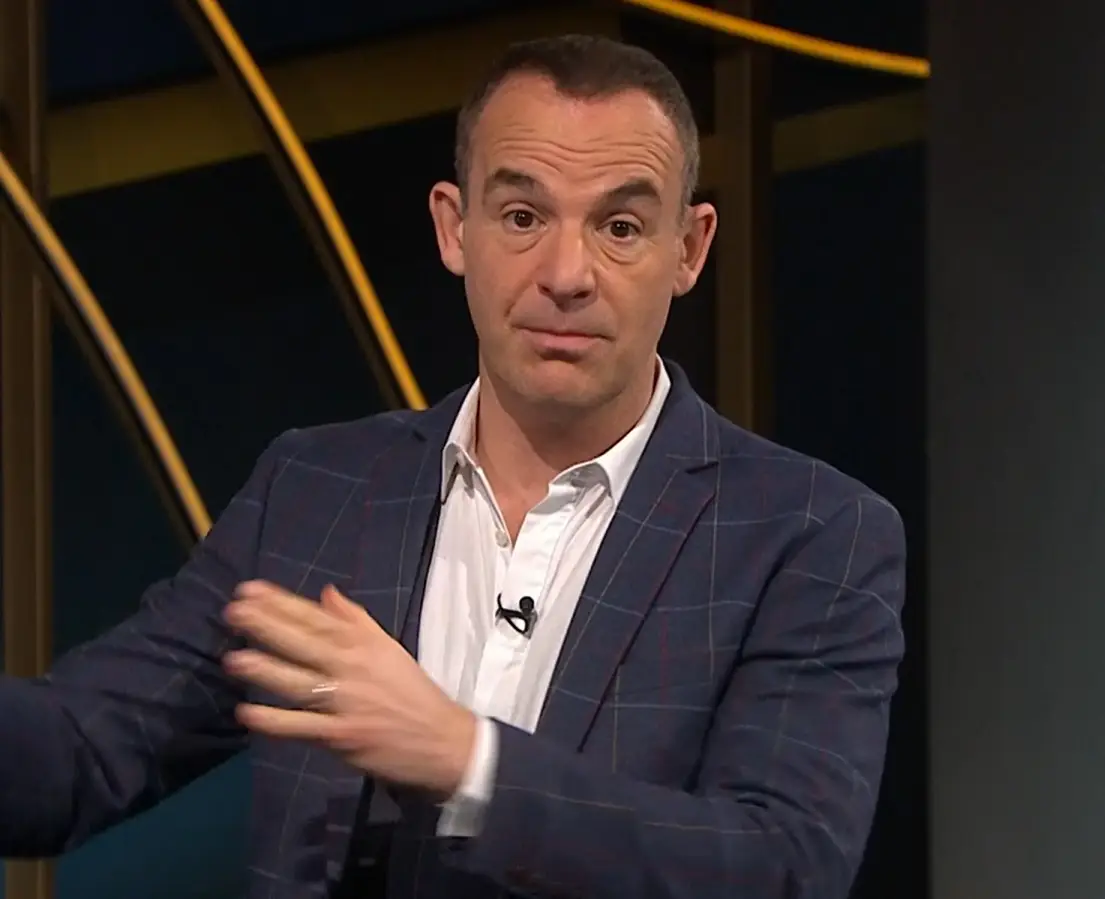

Martin Lewis, the godfather of saving cash, has issued vital new advice when it comes to making sure you pay the right amount of council tax.

The Money Saving Expert (MSE) founder was back on our screens on Tuesday night (16 January) with his ITV show, The Martin Lewis Money Show Live.

The timing couldn't be more perfect for UK residents, with inflation increasing unexpectedly to four percent.

Advert

On the show, viewers saw Patrick and Heather from Norfolk, who had assumed their council tax bill was right.

But after tuning in to Lewis' programme, they thought twice.

Patrick said: "We filled in the application. It’s not hard.

"It was successful. We did receive a rebate of £1,755.

“Before we were in band E, which worked out to be about £245 a month. We’re now in band D and that’s about £200.”

Another viewer shared with Lewis how they won back more than £7,000 in overpayments.

Taking to the MSE website, Lewis wrote that 'hundreds of thousands of homes across England and Scotland are thought to be in the wrong council tax band'.

As a result, Lewis says it's really important to make sure you check your property is in the right banding.

"Some people have been overpaying for many years (even decades) and the issue is only compounded by annual hikes to council tax rates, so pay-outs worth £1,000s are commonplace," he goes on to say.

The current council tax system itself is a bit of a weird one. It was created back in 1991 in a bit of a rush.

This meant, Lewis says, that they 'didn't have time to get the detailed information together, so they set about doing it quickly by pairing up and driving down countless streets, allocating each property a band with just a glance'.

The system means you could well be paying more than your neighbours even if you live in a property that is the exact same size.

So, how do you go about challenging the band your home is in if you think you could be overpaying?

Lewis says it's well worth asking 'what council tax band am I in?'.

"Get your banding decreased and, as well as paying between £100 and £400 less each year, the repayment should be backdated to when you moved into the property – as far back as when the tax started in 1993.

"MoneySavingExpert.com reported a massive reclaim success a few years back, where one man challenged his band and saved himself and his 29 neighbours £10,000s."

The first stage of checking if you're due a payout is to check the rates of your neighbours or identically built properties in your area.

The bands for every property are available on Gov.uk.

The next step looks at doing a valuation check.

Lewis says: "If you bought your house after 1991, you can simply use its price and date of sale to do this. If you rent or bought earlier, you'll need to find an estimated price."

Basically, this stage will tell you if you're paying the right amount and your neighbours are underpaying. If you appeal, and get theirs upped, it 'wont make you popular', Lewis says.

The next step sees Lewis throw in a 'serious warning'.

He says: "You can't just ask for your band to be lowered – only for a 'reassessment', which means it could be moved up or down.

"It's even possible that your neighbours' band could be increased, although this is rare.

"This is why it is crucially important you do BOTH of the checks, and to be especially careful if you've added an extension or something that increases your property's value."

The long and short of it - if you have checked against your neighbours' rates and checked out your 1991 valuation compared to the banding rates, and you still think you have a case, your chance of succeeding with the claim is strong.

It's then time to appeal, which you can once again do on Gov.uk. Good luck!

Topics: Money, Martin Lewis, UK News, TV and Film