With 2023 done and dusted, many of us are not only experiencing the January blues but are patiently waiting for a late payday.

This time last year, 92 percent of UK households said that their cost of living had increased from 2022 - according to Statista.

But to avoid any further strain on the wallet, it's probably worth keeping up to date with some of the current and upcoming financial changes, both good and bad:

Advert

Applications open for free childcare - January 2

From April onwards, parents of two-year-olds will be able to access 15 hours of free childcare a week.

Working parents will need to individually earn more than £8,670 but less than £100,000 a year for eligibility.

The government announced that the 15 hours will also be extended down to the age of nine months.

Inflation - January 17

Inflation is a percentage figure to measure how prices have changed over time.

UK Inflation is currently at 3.90 percent, compared to 4.60 percent last month and 10.70 percent last year.

For context, low, stable and predictable inflation is what seems to be favourable.

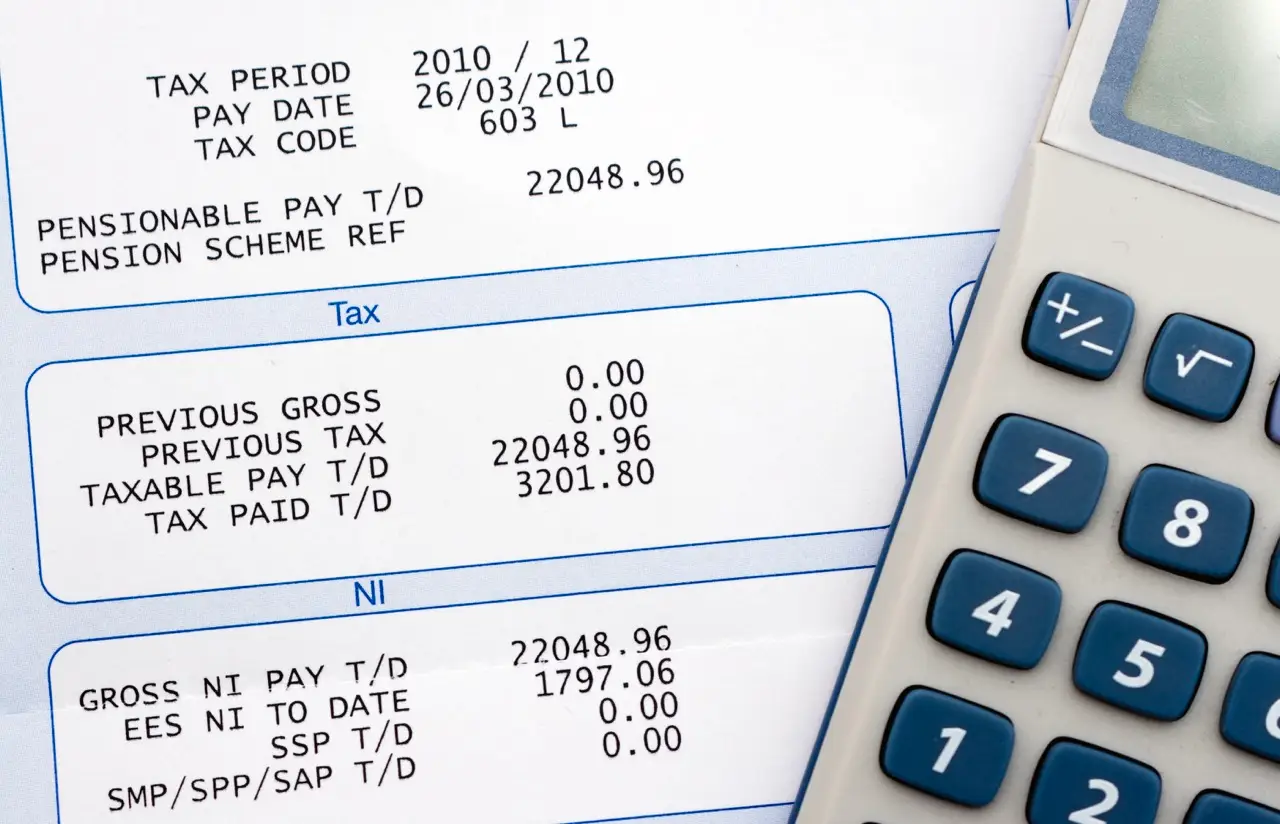

Online HMRC self-assessment deadline - January 31

Millions of Brits will get a £100 fine through the post if they don't act quickly.

HM Revenue and Customs (HMRC) has said that 5.7 million people have less than a month left to file their 2022-23 tax return.

So, make sure you don't miss the January 31 deadline and risk a £100 fine - plus further potential penalties.

HMRC said the quickest and easiest way that customers can pay their tax bill is via its app.

Information about the different ways to pay can be found on GOV.UK. People who are unable to pay in full can also access support and advice on the site.

£299 cost of living payment - February 6

People in the UK could be eligible to receive a tax-free, £299 payment due to the cost of living crisis.

The full list of benefits it applies to are:

- Universal Credit

- Income-based jobseekers allowance

- Income-related employment and support allowance

- Income Support

- Working Tax Credit

- Child Tax Credit

- Pension Credit

To receive the payment, you have to have been eligible for one or more of these benefits between August 18 and September 17.

Bereavement support deadline - February 8

Although widowed parent's allowance has now been replaced by bereavement support payment, for a limited time, you may still be able to claim backdated help if your household partner died after April 8 2001 and before April 6 2017.

This option could be worth thousands, but it must be claimed before the deadline.

Rail fares rise - March 3

Rail fares are set to be increased by 4.9 percent in March 2024 - a rate which has been capped by the government.

Minimum wage rise - April 1

This year, we will see an increase in the national minimum wage.

For those aged 21 and over, it'll go from £10.42 to £11.44, an increase of 9.8 percent for the lowest earners in the country, otherwise known as £1.02.

For 18 to 20-year-olds, it'll go from £7.49 up to £8.60, an increase of £1.11.

For those who are 16, 17 or on an apprentice rate, the wage is increasing by £1.12 to make it £6.40.

Council tax rise - April 1

The amount councils in England can put up council tax without holding a local referendum has been increased as those with social care duties can raise council tax by five percent, while others can put it up by 3 percent.

TV licence rise - April 1

The licence fee increase of 6.7 percent is said to be in line with inflation.

Tax cuts for self-employed - April 6

Taxing for the self-employed will go from 9 percent to 8 percent as the average self-employed person in the UK will gain £350.

Benefits and state pension to rise - April 8

Universal Credit is expected to rise by 6.7 percent and a 8.5 percent rise can also be expected for the state pension.

Register for self-assessment - October 5

For those registering for self-assessment tax for the first time, the deadline is October 5.

Warm Home Discount - October

If you want £150 off your electricity bill for the winter period, sign up to the Warm Home Discount Scheme.

Contact the Warm Home Discount Scheme before 29 February 2024 to see if you're eligible.

Winter Fuel Payment - November

Millions of pensioners are also lined up to receive a Winter Fuel Payment, which could be anywhere up to £600.

If you were born before September 25 1957, in most cases you will be eligible.

This will happen automatically if you receive any of the following:

- State Pension

- Pension Credit

- Attendance Allowance

- Personal Independence Payment

- Carers Allowance

- Disability Living Allowance

- Income Support

- Income-related Employment and Support Allowance (ESA)

- Income-based Jobseeker’s Allowance (JSA)

- Awards from the War Pensions Scheme

- Incapacity Benefit

- Industrial Injuries Disablement Benefit

- Industrial Death Benefit

Any payments received from this scheme will not impact future benefits.

Cold Weather Payments - November

If you’re getting certain benefits or Support for Mortgage Interest, you may be eligible for £25 for each 7 day period of very cold weather from zero degrees celsius or below.