Robert Pape said he reckons that President Trump is 'on the horns of a dilemma'

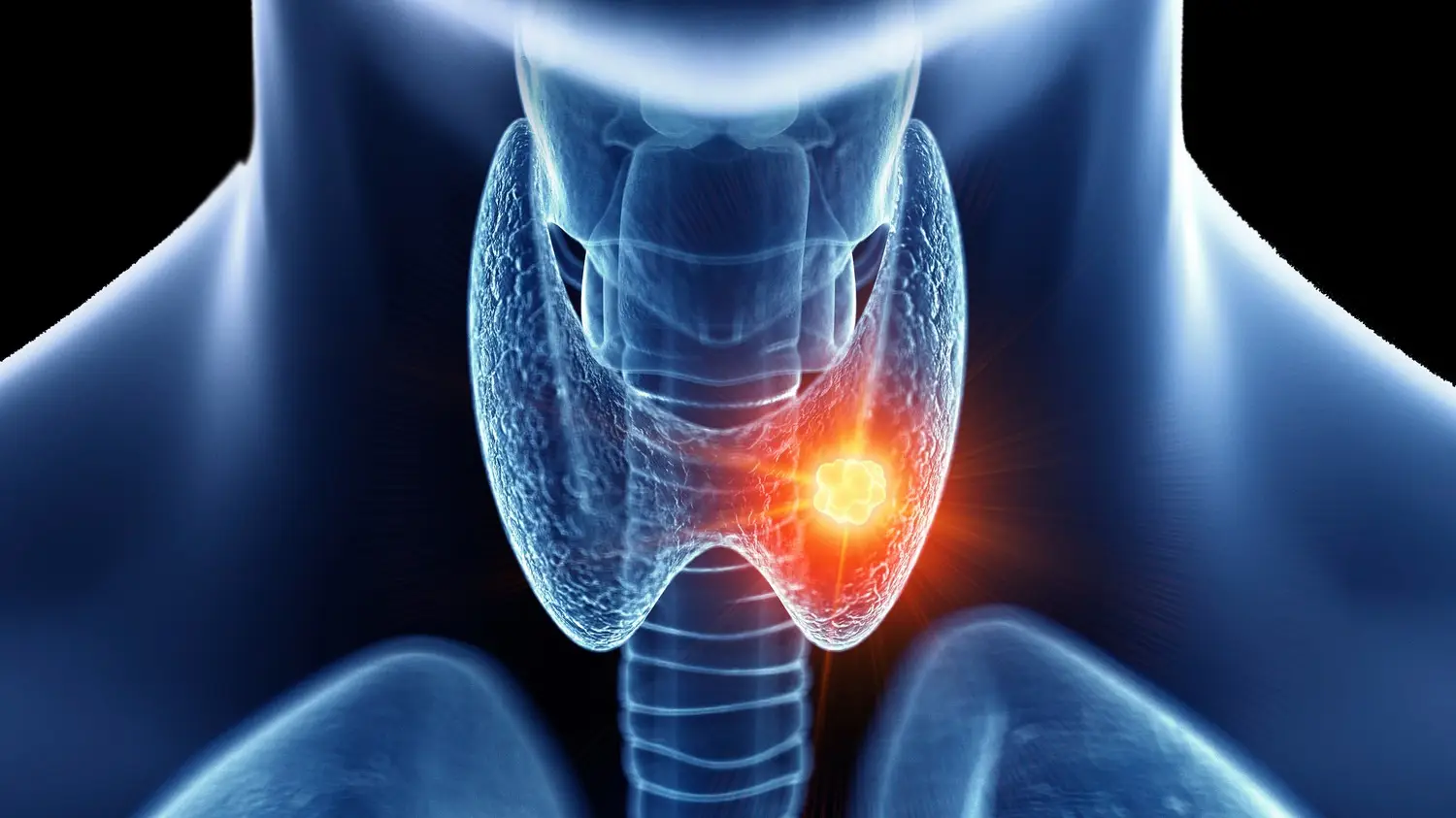

The 54-year-old said her 'world changed again in an instant' after a routine scan

The tech giant has got rid of more than a dozen devices

The killer was a white supremacist skinhead who acted in gay porn

It has the lowest survival rate of common cancers

More than 4,000 Americans have launched lawsuits against pharmaceutical companies

The Oscars have massively increased their security due to an ongoing warning in California from the FBI

Rachel Tussey, 47, had told her thousands of followers she was 'in good hands' before heading into surgery

"It makes us crave each other more"

Still looks better than my uni accommodation

The footage revealed how much firepower the Iranian military has under its belt

The discovery proves that life forms exist even in the most extreme environements

He succeeded his late father as supreme leader

It's not just so you're set for the apocalypse

The judge told mother-of-ten Amanda Wixon she was in 'permanent denial' about the impact of her offending on the woman

Experts have revealed that symptoms can take as long as 20 or 30 years to show

Vladimir Solovyov has once again set his sights on the UK following Ukraine's latest strike

Customers have reported the same 'glitch' on their banking apps

The FBI issued a warning Iran could be planning an attack from the coast of California

Experts have advised what you should be doing instead

The astonishing claim appeared in Louis Theroux's new Netflix documentary, Inside the Manosphere.

A new video reveals the lengths Iran will go to in order to stop Donald Trump and the US

It comes after Trump claimed the war was 'very complete'