An NHS nurse has revealed how she has just £24 a week to live off after bills, having had to find new ways to get by amid rising living costs in the UK.

Single mum Heather Johnston, 30, has had to make drastic changes to survive, from remortgaging her house to downsizing her car – as well as avidly sticking to yellow sticker reduced price food and tracking down the cheapest spots for petrol.

Johnston, from Glasgow, Scotland, is also regularly faced with the tough decision of choosing between spending more time with her children and taking on extra shifts at work.

She explained: "Everyone is struggling but people are under the impression nurses [are] better paid than most, but that isn't true.

Advert

"I'm a single mum, I have no government support, I work full-time five days a week for eight hours, and I pay nursery fees.

"I only get 20 percent back for childcare, but my bills are horrendous.

"I know there are people worse off than me and the jobs people do regardless of healthcare. I know people have less than me but nursing isn’t a well paid job and the impact [of] the costs of living are so bad, I don’t know how people are managing.

"I only have £24 a week to live off after all of my bills are paid, it's tough.

"I'm now not buying anything new unless it's underwear. If I want anything that is out of my bills and the £24 I have left I will have to work extra shifts.

"I already work five days a week but I would have to work an extra day. I do that quite a bit now, and even on my annual leave I did two extra shifts. I can’t afford to not work.”

Johnston, who is mum to 12-year-old Dominic and three-year-old Olivia, saved an extra £70 a month when she remortgaged her house, and was also forced to downsize her car from a Ford Ecosport to a Fiat 500, in turn scraping back a further £60 a month.

"Before the rise of bills, my electricity and water was £70, it has now doubled,” she said.

"My monthly outgoings are now going on my mortgage which is now £335, my council tax which is £140, I have a loan repayment of £240, the electricity and water is £140, my car is £232 and the insurance is £50.

"I also pay £500 for my daughter a month and my WiFi is £60."

Johnston now spends £2,000 in total each month, but is always having to make cuts wherever she can.

She said: "I can't afford to buy fresh fish or meat, so I would only buy it when it's reduced and freeze it.

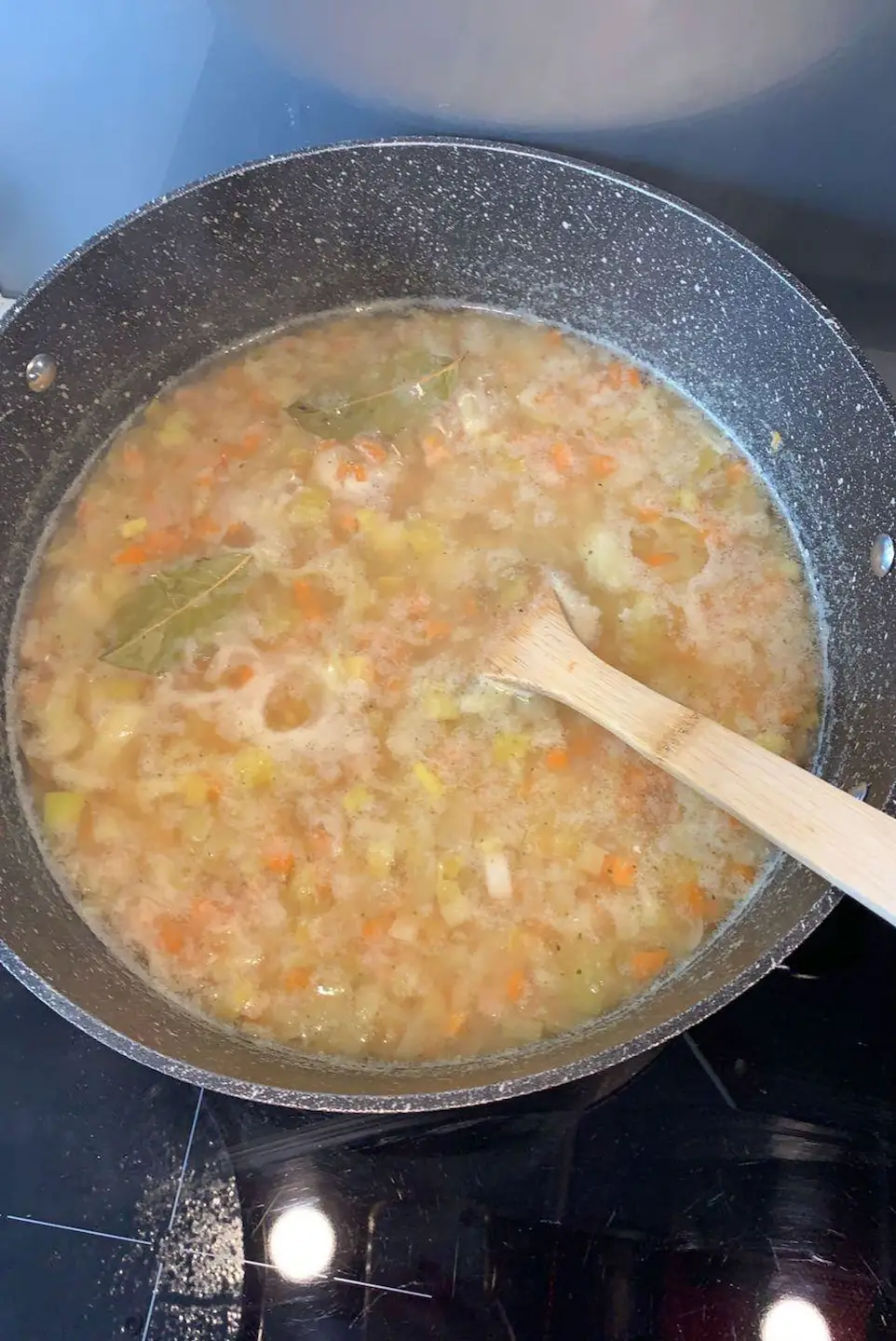

"I've taught myself how to batch cook and I typically cook lots of Bolognaise and pasta dishes, I also make chicken curries and basic dishes as well with peppers, onions and mushrooms."

Johnston only goes to Costco for petrol as it’s ‘cheaper’ and has started selling some of her belongings on Vinted while hitting up charity shops, websites and family members for second-hand clothing.

She said she knows things are taking ‘such a toll’ on her children, but remains happy that she’s stuck with nursing – having always wanted to go into a job that involved caring for people.

But Johnston is still worried about prices continuing to rise, adding: "Something has to give soon, I hope so."