An incredible analysis of house prices in the UK has revealed how much the average home cost people 50 years ago.

Property prices continue to skyrocket, jumping by 9.6 percent over the year to January 2022.

According to the Office for National Statistics, the average UK home costs £274,000, up by £24,000 since the same time last year.

To put things in perspective, SunLife, which offers insurance to the over 50s, has taken a look back at the average house price over the decades.

Advert

Back in the 70s, it was a polarising time for the UK economy, with both widespread hardship on the one hand and a boom in home ownership on the other.

As the mortgage market flourished, the average house price at the start of the decade was just £4,057.

The UK House Price Index shows this jumped to £5,158 by 1972, which is still a stark contrast when compared with the figures we see today.

Let’s put this into further perspective by looking at the salaries then and now – in 1972, the average annual salary for men over 21 was £1,903, while women over 18 only earned £1,066 on average, according to Hansard.

This means a house cost 2.7 times the average yearly wage for British men and 4.8 times the average annual salary for women 50 years ago.

HMRC data shows that the average UK salary at the start of 2022 was £24,600, making a home over 11 times the median yearly wage.

Figures may vary slightly, but overall what this illustrates is that the disparity between house prices and wages has grown significantly over the past five decades.

That being said, buying property is low on many people’s list of priorities right now amid the cost of living crisis.

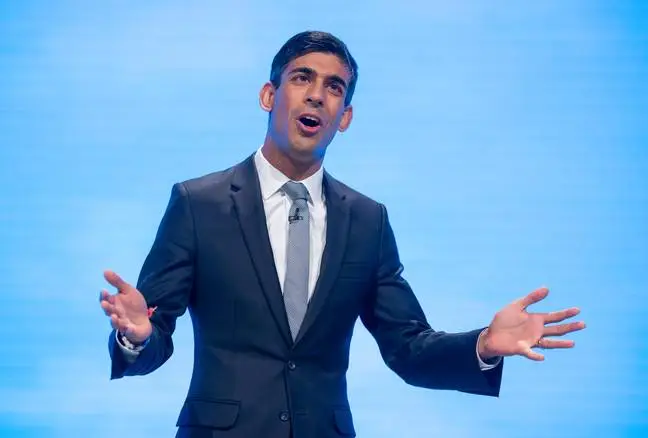

As Chancellor of the Exchequer Rishi Sunak made his Spring Statement to Parliament last month, it was revealed that inflation had hit a new 30-year peak.

Prices rose by 6.2 percent over the last year to February, seeing fuel, food and energy costs spiralling out of control.

Even Martin Lewis - the Money Saving Expert himself - has said there is 'virtually nothing' he can do to help people anymore.

Prices are rising at such an exponentially faster rate to wages at the minute that the Bank of England believes inflation could hit double digits this year.

Fuel prices have been hitting new record highs in recent weeks, and the biggest jump in domestic energy bills in living memory also came into effect at the start of April, leaving many families facing further financial struggles across the UK.