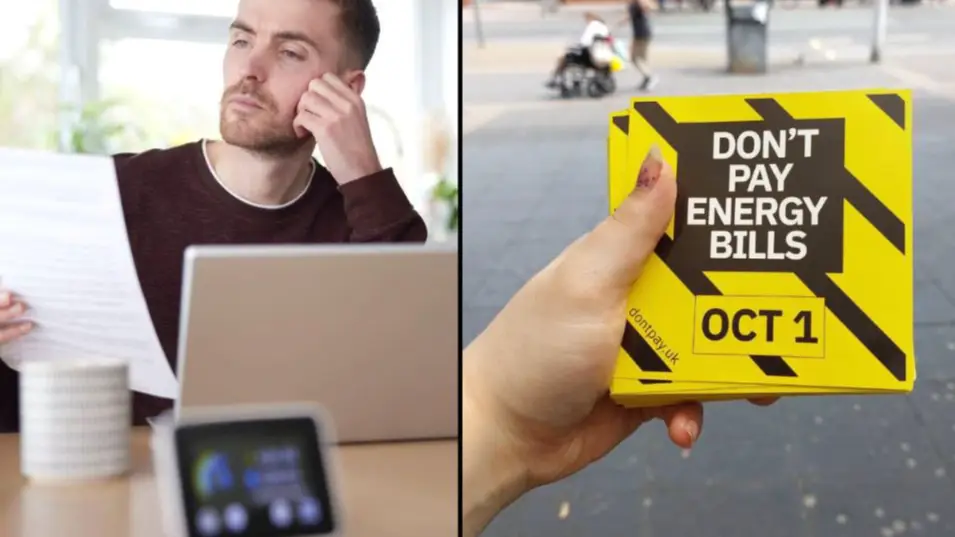

The cost of living crisis has got the majority of us seriously rethinking our energy usage this winter, and for some, this means drastic action.

But now a debt expert has issued a warning ahead of Don't Pay UK – a campaign that's encouraging as many people as possible to simply not pay their energy bills come October.

The campaign has been running since June, and the date was set because of the upcoming price cap increase, which is expected to put more than half of UK homes into fuel poverty.

Advert

While Don't Pay UK might be making a point, debt experts are advising against refusing to pay your bills because of the consequences this could have further down the line.

The Debt Support Centre has warned that energy bills are classed as a high priority expense, which means that if they go unpaid there are some serious consequences – regardless of whether it's done on mass.

To begin with, if you fail to pay, you could be subject to a late payment fee that's unique to your energy provider, and this will be registered on your credit report.

Then, if you go as far as to not pay for three to six months, a default could be added to your credit report, which could cause you all sorts of problems later in life, such as when applying for a mortgage.

This is because it lets banks know that you broke the terms of your credit agreement.

Finally, there's the issue of debt collection agencies, which could be used to collect what you owe by your energy company.

This can be enacted in a number of ways from the automatic deduction of the money from your wages, or they could go as far as to send bailiffs to your home.

Financial Expert at Debt Support Centre, James Gibson, said: "We understand that life is financially challenging for many, and with the October price cap rise, joining the Don't Pay UK campaign feels like a way to send a strong message to the government about our struggles. However, there might be better ways to deal with our energy-related debts that wouldn't damage our credit files.

"There are schemes, grants, and benefits available from energy suppliers and the government to help people through these challenging times. We suggest seeing if you qualify for these solutions before considering not paying your bills. Failing that, many charities and debt help companies can help you find a less drastic solution to your financial problems."

The Debt Support Centre stressed that if you're struggling to pay your energy bills come October, you should seek out an alternative form of support instead of joining Don't Pay UK.

They explained that you can set up a payment plan with your provider to pay off the cost over a longer period of time (after all, bills in the winter are typically higher than in the summer).

Meanwhile, if you receive either Jobseeker’s Allowance, Income Support, Support Allowance, Pension Credit, or Universal credit, your benefits could cover what you owe without affecting your credit score.

They allow people a fixed amount to cover this particular expense.

LADbible has reached out to Don't Pay UK for comment.