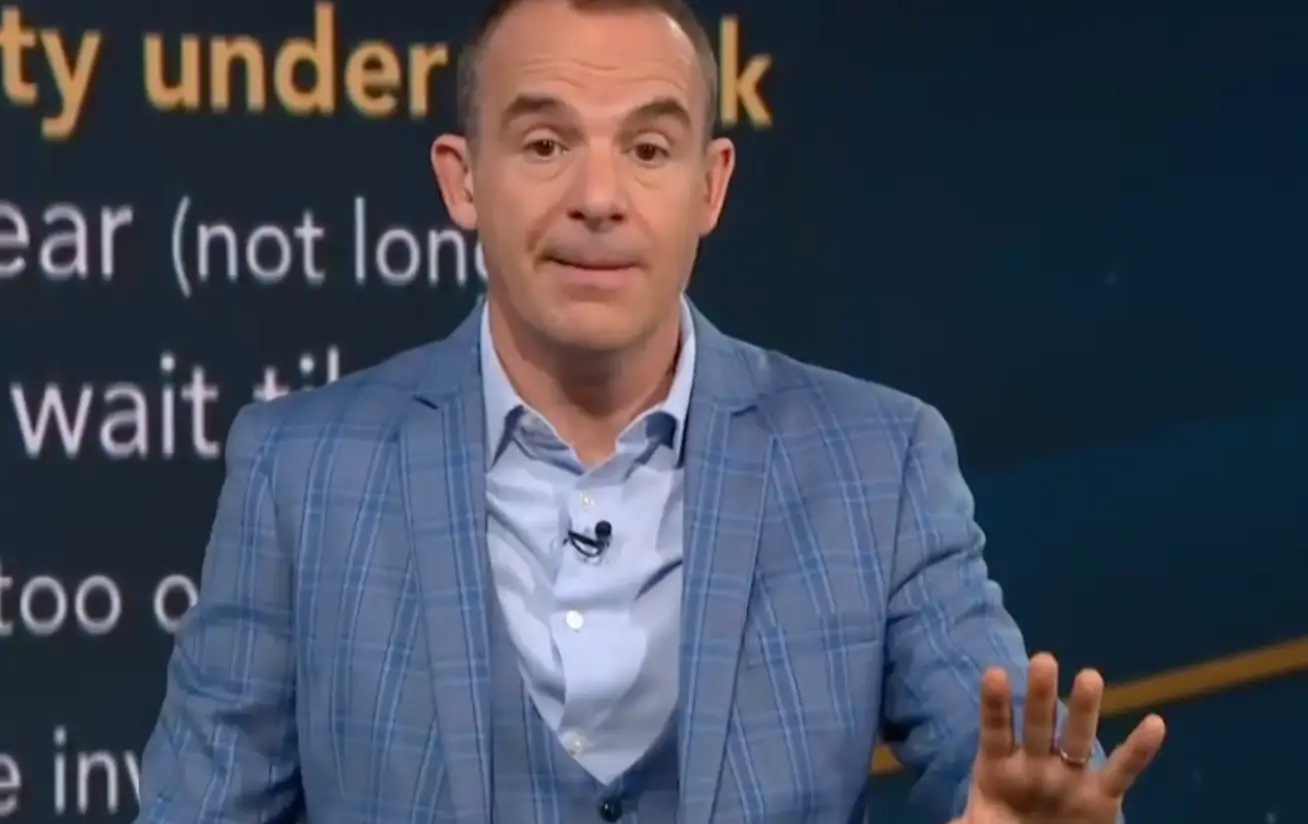

Martin Lewis has issued an urgent warning to those born between two specific years.

The Money Saving Expert explained that people born at a certain time should be putting £1 into a specific bank account.

Speaking on his ITV show, Lewis said: "For anyone who's never owned a house, put a quid in.

Advert

"Because you have to have it open a year before you can get the bonus. So you may as well put a quid in now in case you want to use it in the future."

He explained it would be clever to open one for grown up kids, too.

"Great to do if you've got 18-year-old kids and you want to put money in for them," the financial expert added.

"Get them to put a quid in, it's a clever thing to do right now."

This warning was aimed viewers born between 1985 and 2006.

Lewis said those aged between 18 and 39 can take advantage of opening a Lifetime ISA and using a government savings scheme to help them buy a home.

People planning on using the scheme must make their first payment before the age of 40.

The government will add 25 percent to savings (up to £1,000 per year) and the account must be open for 12 months before the bonus begins.

The initiative helps people buy a home up to £450,000, but Lewis also explained that he had urged chancellor Jeremy Hunt to up this limit.

As part of the Spring Budget, Hunt explained that National Insurance was to be slashed by two pence.

However, some will not benefit from the news.

Lewis explained that if you earn between £12,750 and £26,000, or over £60,000, there will be nothing to gain

Over on Money Saving Expert, it explains that both National Insurance and income tax thresholds have been frozen since 2021 and are set to stay frozen until 2028.

"What freezing the threshold does is that it means no matter what you earn, as your earnings increase, a bigger proportion of your earnings goes on tax. And that's how the Chancellor makes money from it," the site states.

Although workers earning between £26,000 and £60,000 will gain more from the National Insurance cut than they would lose from the freeze. This is because the change is offset by the National Insurance threshold freeze.

Topics: Martin Lewis, Money, News, UK News