Certain people are at higher risk of being infected with the bacteria

Amanda Wixon's victim says she carries the 'trauma and nightmares' of what she endured with her everyday

He married his teen bride in Brazil last summer

Live Nation directors said they 'almost feel bad taking advantage of' customers

Tom Bellamy's mum didn't hold back when she was asked about what the win could mean for his future

The Australian relationship coach is stepping back to spend more time with her family

Apparently, all you need is a flexible ISA and a few quid to play with

Robert Pape said he reckons that President Trump is 'on the horns of a dilemma'

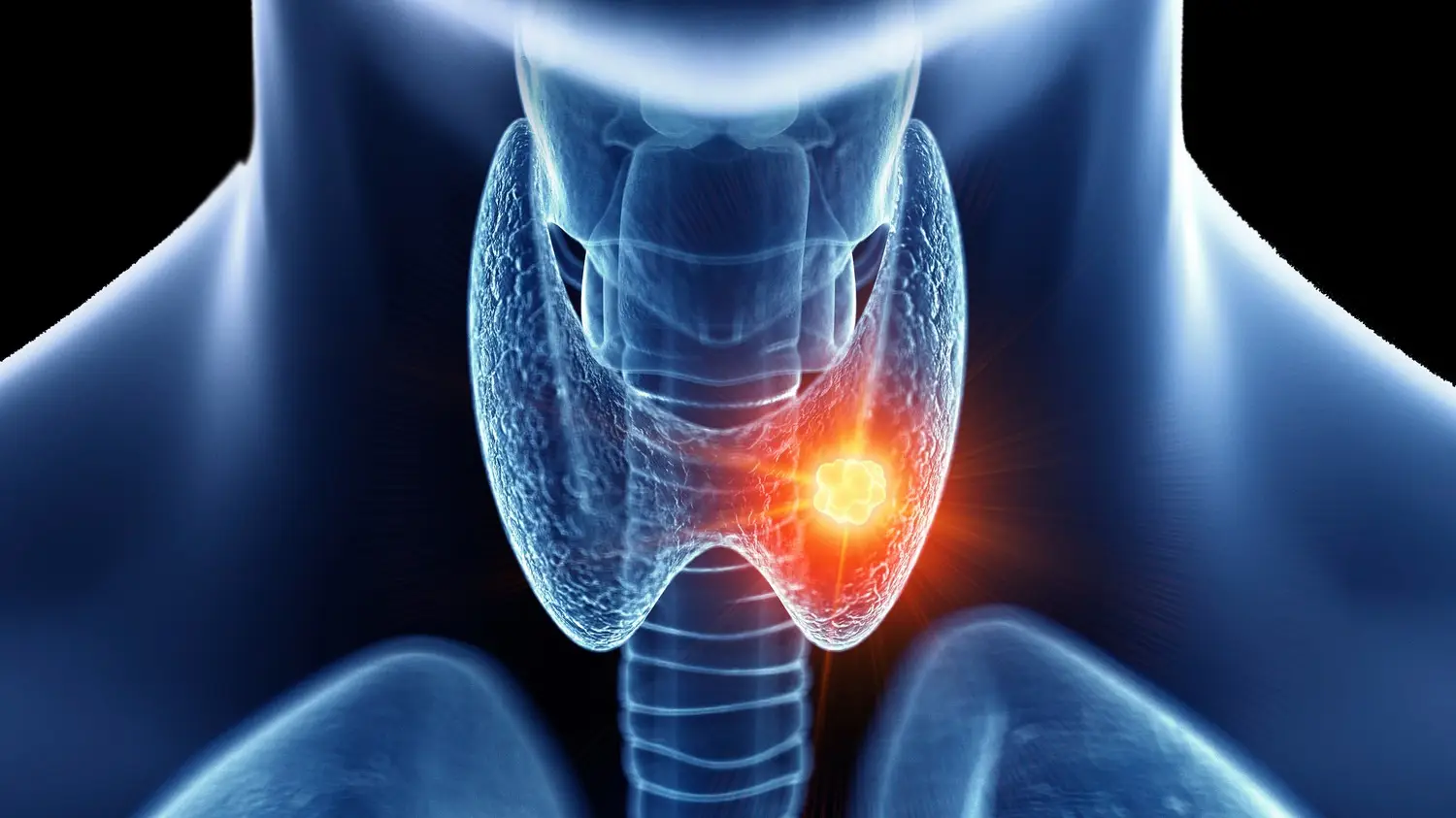

The 54-year-old said her 'world changed again in an instant' after a routine scan

The tech giant has got rid of more than a dozen devices

The killer was a white supremacist skinhead who acted in gay porn

It has the lowest survival rate of common cancers

More than 4,000 Americans have launched lawsuits against pharmaceutical companies

The Oscars have massively increased their security due to an ongoing warning in California from the FBI

Rachel Tussey, 47, had told her thousands of followers she was 'in good hands' before heading into surgery

"It makes us crave each other more"

Still looks better than my uni accommodation

The footage revealed how much firepower the Iranian military has under its belt

The discovery proves that life forms exist even in the most extreme environements

He succeeded his late father as supreme leader

It's not just so you're set for the apocalypse

The judge told mother-of-ten Amanda Wixon she was in 'permanent denial' about the impact of her offending on the woman

Experts have revealed that symptoms can take as long as 20 or 30 years to show