Getting accepted for a mortgage can be extremely difficult for several factors.

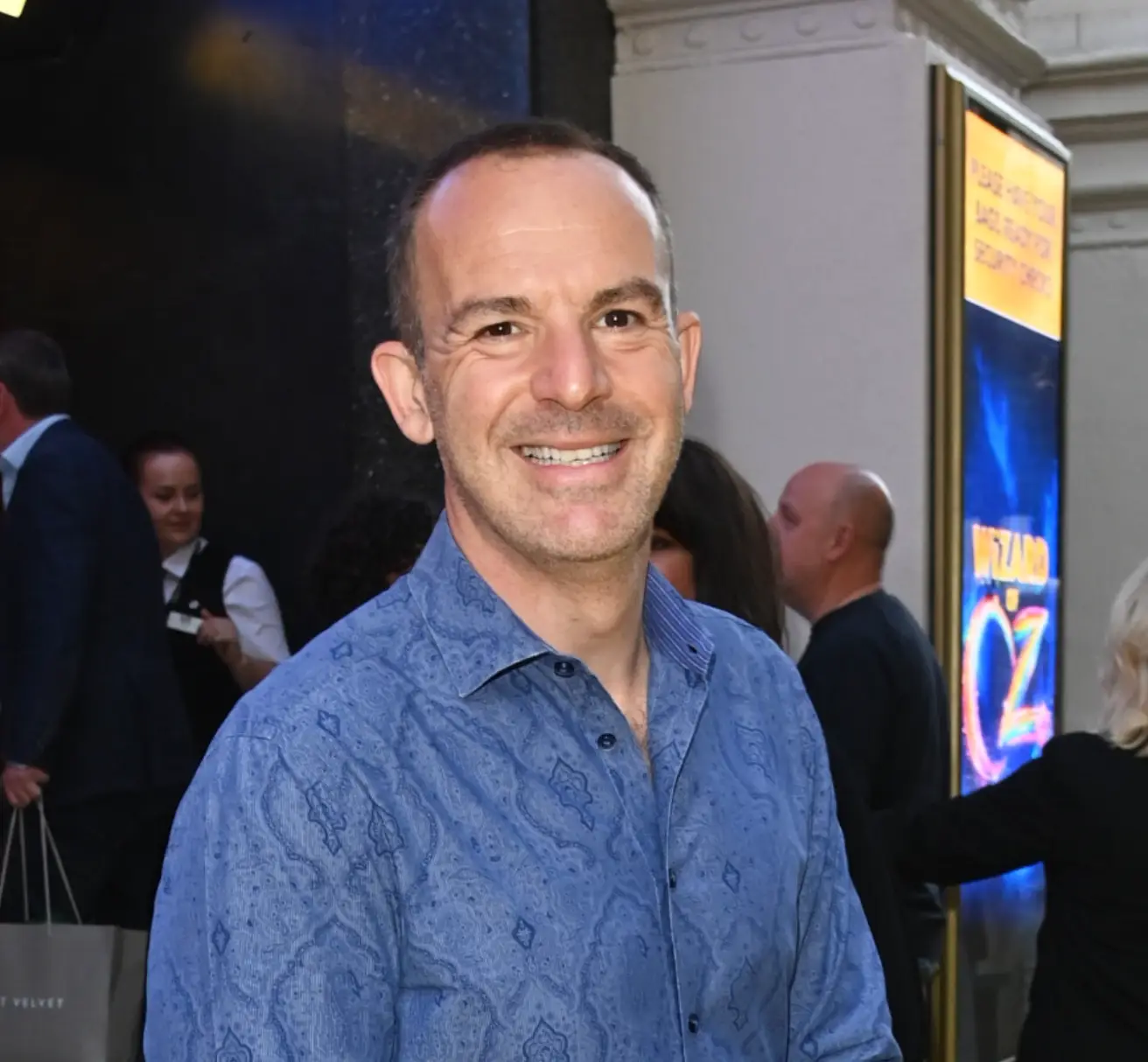

But do not fear; money expert Martin Lewis is here to advise you on how to ensure you'll get accepted for a mortgage.

The money-saving expert was on The Martin Lewis Money Show Live on ITV last night, where he also explained what to do if your landlord raises your rent.

Advert

Speaking about mortgage rates and renters' tips with Robert Gardner, the chief economist at Nationwide, Lewis explained that mortgage rates have finally started to fall - which sounds like a positive sign.

After answering questions about what first-time buyers should be, he explained how the mortgage process works.

Martin explained that lenders always conduct credit checks when reviewing applications, so ensure that you have a high score.

But how can you do this?

Firstly, he says to check your credit report with the three credit agencies, Equifax, Experian, and Transunion, for potential pitfalls.

However, you must be careful while checking this line-by-line to ensure you don't miss any avoidable mistakes.

Lewis said: "I know people who have not got a mortgage because of an old mobile phone that was linked to the wrong address," adding that a case like that could be fraudulent.

I think we've all been there: forgetting to change our address for certain things, so that's easy to miss!

Another key factor is making sure not to complete all payments and pay off your cards every month to show that you can pay large amounts off regularly and on time.

Martin also recommends that first-time buyers conduct an 'affordability stress test', which involves adding a rate to see if you could afford a more expensive mortgage than the one you're currently eyeing.

Another important thing is to be more vigilant with your spending in the lead-up to the application because you will need to supply evidence of income, bills and spending habits.

So, it might be best to hold off on Uber Eats and Deliveroo for a bit. I know it's tough, but we'll all have to do it one day.

And finally, he recommends hiring a mortgage broker if you can, especially if you are 'self-employed, live above a shop or have cladding'.

However, he suggests holding off payment to the broker until the deal has come through.

It's a lot, but why not if it can get you closer to your first home?

Topics: Money, Martin Lewis, ITV, Cost of Living, UK News